private premium financing life insurance

The underlying need for the life insurance may vary for instance it may be due to estate planning purposes a corporate buyout or the need for key person insurance. For clients with an established need for life insurance premium financing can allow them to take advantage of leverage to potentially reduce out-of-pocket costs and preserve.

High Net Worth Life Insurance Estate Planning

Holland Knights Life Insurance Premium Finance Team leverages more than 60 years of combined legal experience in the private wealth and financial services sectors to efficiently.

. When you purchase a life insurance policy that. Investments Financial Planning. How Does Private Financing Work.

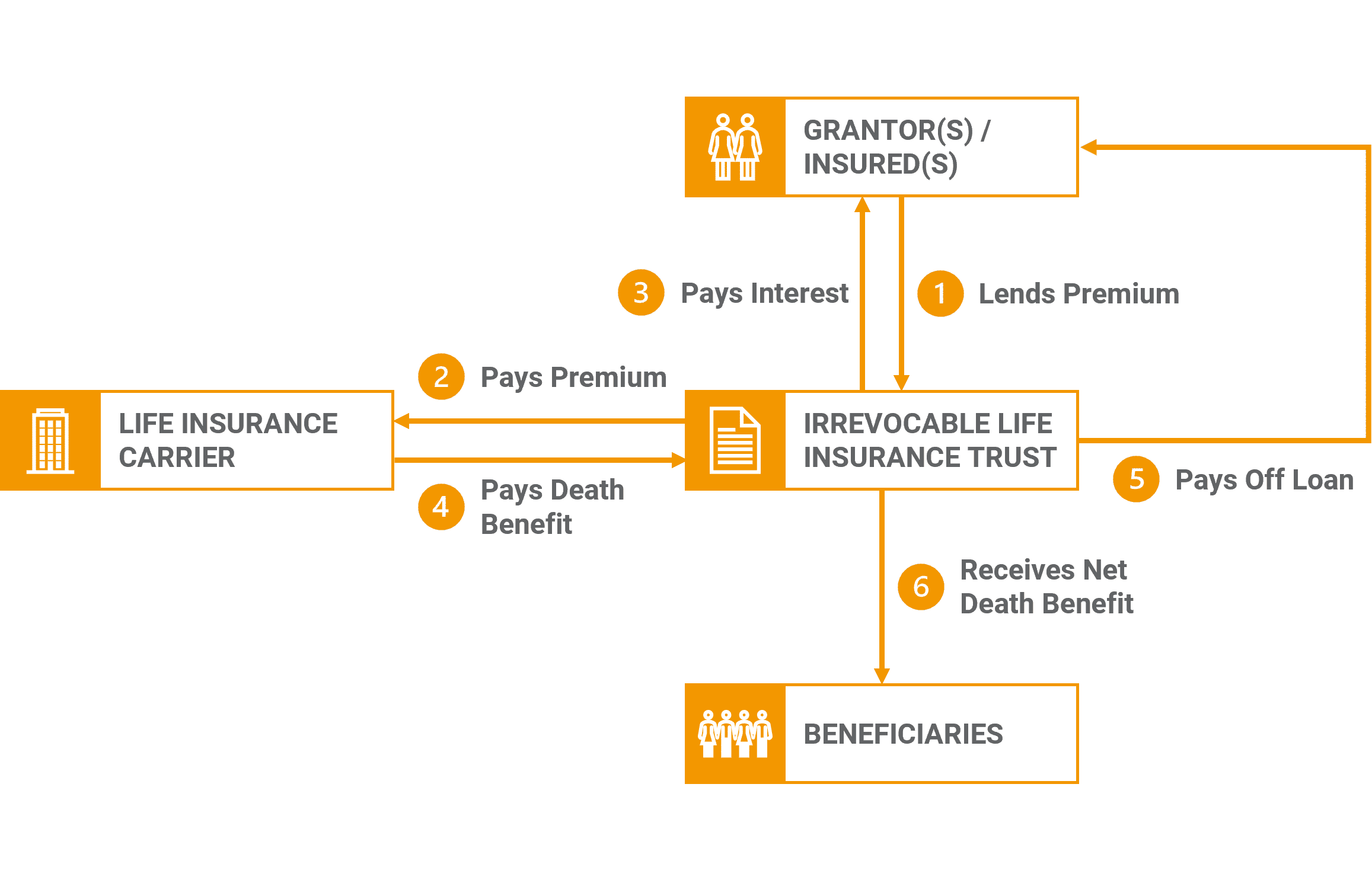

Premium Financing is an insurance funding arrangement that can help you benefit from life protection while enjoying financial flexibility. Permanent life insurance offers specific benefits that improve the premium financing picture. A creative solution is to create an Irrevocable Life Insurance Trust ILIT with daughters as the beneficiaries.

In the typical private premium financing arrangement the Grantor makes a loan to an ILIT that is structured as a Grantor Trust1 The trustee uses the. Instead of making payments directly to the insurance carrier the insured will work with a premium finance. Insurance premium financing is essentially a loan that a business takes out to purchase an insurance policy such as life insurance or a retirement policy.

In this example the family could use private financing to fund. Universal Life Insurance Premium Financing Solutions for High Net Worth Clients in over 200 countries. Here is a list of private banks that are active in premium financing of life insurance policies which includes the loan values available and other criteria that a bank will want.

Premium Financing is an insurance funding arrangement that can help you benefit from life protection while enjoying financial flexibility. The carried-over 1600000 in cash value and an additional 700000 financed by a bank specializing in premium financing. Serving Wealth Managers Life Insurance Brokers Trust Companies Private Banks.

Real Estate Services Statewide. Insurance premium financing is similar to other types of loans. Premium financing life insurance is the process of borrowing money to pay large life insurance premiums.

The loan is secured. Annual premiums will typically range from 100000 on the low-end. The annuity plan will then start paying a monthly income to Tom at the end of the second policy year at a projected rate of 3648 of the net single premium of 1000000.

The funding for the new policy was in two parts. For example whole life insurance pays policy dividends and this offers tax. When you purchase a life insurance policy that.

Premium Financing As Tool For Life Insurance Funding

Development Finance Blended Finance And Insurance Emerald Insight

What Is Life Insurance Premium Financing Youtube

Life Insurance Planning In 2021 The Cpa Journal

Planning For The Uhnw Client Part Ii Generational Split Dollar Ppt Download

Life Insurance Premium Financing J P Morgan Private Bank

The Benefits Of Premium Financing For Life Insurance

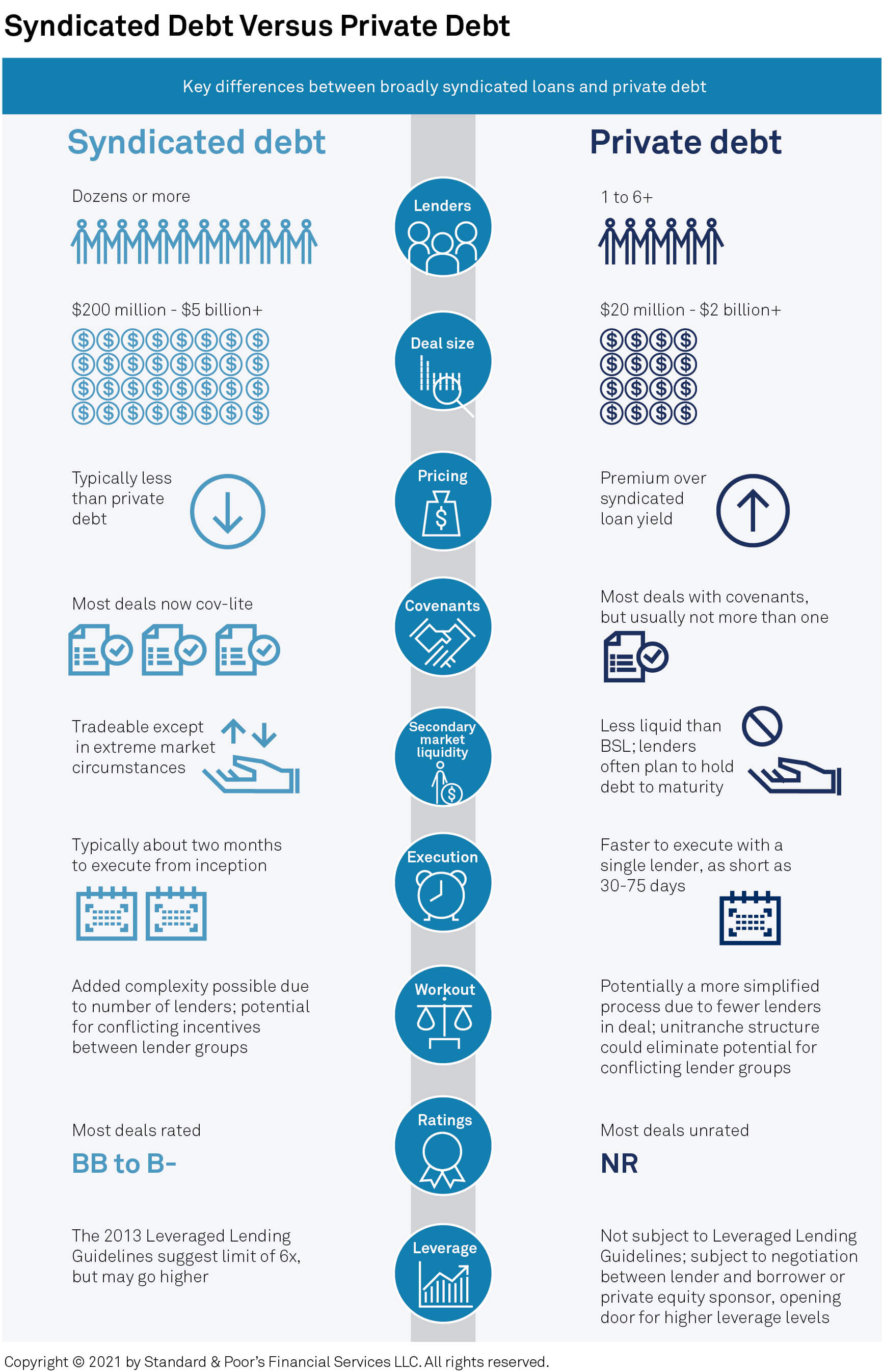

Private Debt A Lesser Known Corner Of Finance Finds The Spotlight S P Global

What Is Life Insurance Premium Financing Youtube

Why You Should Be Careful With Life Insurance Policy Loans Forbes Advisor

Minimum And Maximum Over Funded Life Insurance Policies Innovative Retirement Strategies Inc

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png)

How To Calculate Insurance Premiums

2022 Ultimate Guide To Premium Financed Life Insurance Banking Truths

Funding Options For High Net Worth Clients Ppt Download

:max_bytes(150000):strip_icc()/InsurancePremium_Final_4194539-be0deecca0684aa68a8a4101b83823f6.png)

Insurance Premium Defined How It S Calculated And Types

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium